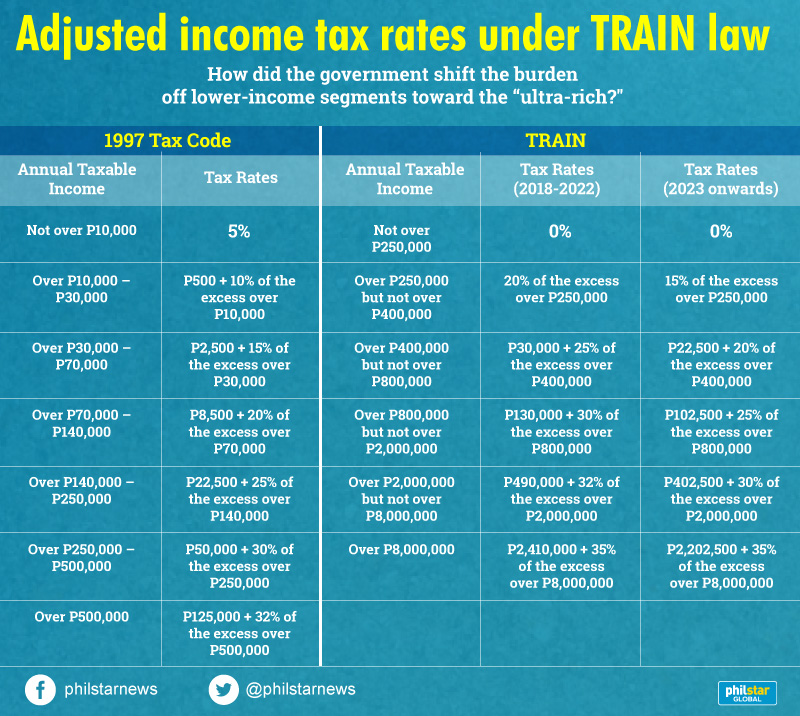

New Income Tax Brackets For 2025 Philippines. The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income. Employees with annual earnings above php 250,000 to php 8,000,000 (or over php 20,833 to php 666,666 monthly) have lower tax rates ranging from 15% to 30%, from.

Tax Bracket Philippines 2025 Henrie Liliane, New income tax brackets for 2025 philippines images references :

Philippine Tax Bracket 2025 Esme Cecilla, Navigate through financial changes with our tool, providing clarity on.

2025 Tax Brackets Philippines Emlyn Iolande, Check the income tax table for 2025 in the philippines.

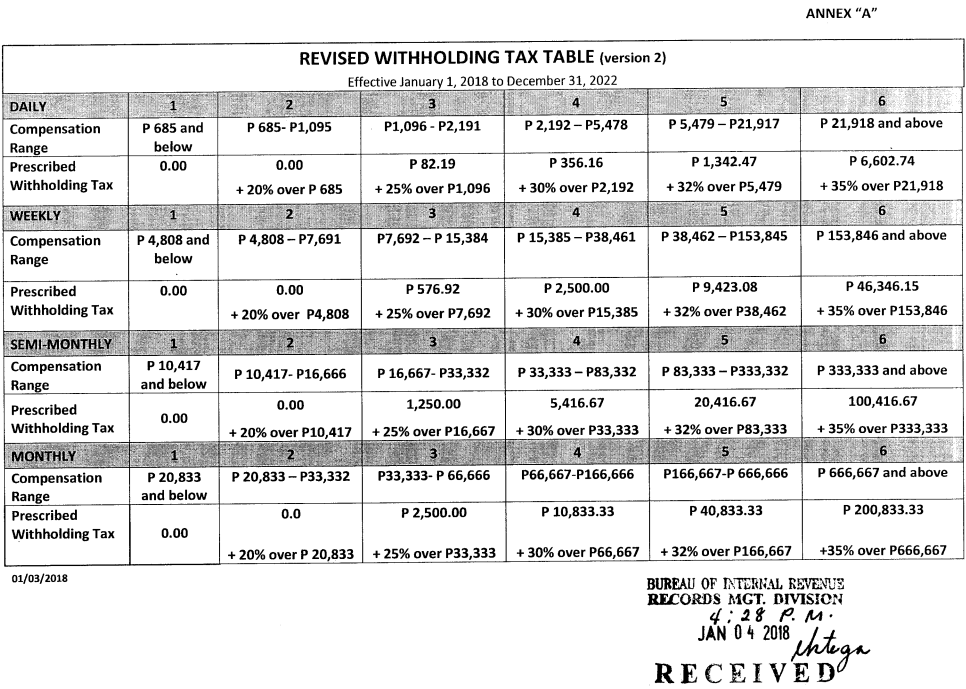

Tax Table For 2025 Philippines Image to u, The tax tables below include the tax rates, thresholds and allowances included in the philippines tax.

New Tax Tables 2025/25 Ruthy Ginelle, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines.

tax calculator philippines Teofila Arredondo, Good news arrives for filipino employees, as the tax reform for acceleration and.

New Tax Brackets For 2025 Philippines Tybi Alberta, Clarifies certain issues relative to the implementation of section 19 of ra no.